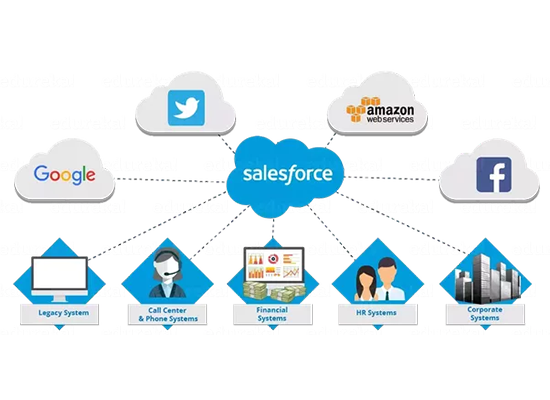

In recent times, Salesforce, as declared GA (Google Analytics) for “Financial Service Cloud” having the core game plan in the queue helps financial advisors in building trusted and strong relationships with the fresh and all-new Connected Clients’ world.

Salesforce Financial Service Cloud On a Row of Development And It’s Important Too Nowadays

Current customers tend to demand more for transparency in a manner that they manage their “money world”. The increasing regulatory omission is putting an extra pressure on the profitability of advisor and a campaign to hold onto their pre-existing worthy clients is intensifying.

To meet such requirements, because barriers are in the continuation process, the advisors are in the state of adjustment to change the business models of theirs. These changes plus the advantages of Salesforce incorporates:

A list of benefits of Salesforce:

1. Deeper One-on-One Client Relationships

Having Salesforce Financial Services Cloud in your favor, easily a consultant can create an attractive and

interesting relationship with their customer, using particular data models and business processes.

Consultants have the power to view and even administer their relationships with customers, their respective families, and widespread specialized teams like estate planners, tax accountants, etc.

The design of the product is done in such a manner so as to help the advisor or consultant to go with the outside limits of sales pitch or single transaction and then further move in the lane of understanding the goals, needs of the client, and the events of life. Third-party applications of pre-integration like AppExchange lets consultants/advisors to acquire data easily, which is required to find fresh opportunities in business growth.

In accordance with rich and high-quality information, Salesforce has built a new strong lightning platform in Salesforce with the user experience, which makes it easier for a consultant to have the control over essential conversations by letting the access and take actions on effortless information available.

2. Smart Actions

In this modernized world, most of the financial advisors depend on the manual of “Standard Operating Procedure” (SOP) in order to have increased productivity and also to maintain compliance. While on the other hand, clients are claiming for more interactive and social experience compared to traditional email and phone.

Advisors can dedicatedly manage their customer’s need and goals with the help of Salesforce Service Cloud while efficiently working the success of the business.

Smart Actions introduces the advisors with important actions and tasks to have in storage, the effectiveness, and the relevance while staying on the topmost priority of the customer’s mind.

3. Real-Time Client Engagement

Further to long-established clients of baby-boomer category, remember that the millennials from brand-new generation are on their feet and up for the cutthroat competition in the market. The expectations of these

new clients increased the technology-oriented and social communication via mobile apps, improved capabilities of self-service, access to instinctive information, and much more transparency.

Having Salesforce Financial Services Cloud in action, consultants can easily engross with their customers on preferred communication channels of the client. They can be more engaged so as to provide the appropriate advice instead of only communicating through email or paper in terms of transactions.

4. Lightning

In the salesforce development, Lightning is another platform which empowers high-quality user experience accompanying interlocking of information from miscellaneous sources of data which is consistent and

is dependent on circumstances on all parts of access devices. Let’s say, when the advisor views Client record, he/she can go through the summarized information along with Net Financial Account information handled. For example, when an advisor is viewing the Client record, he can view the summarized information as well as Total Financial Account by the accumulative platform such as Yodlee.

Likewise, when the advisor witnesses the household view, then anyone has the power to view the accumulated/aggregated information about one another of each member of the household. On the flip side, technical sound, skilled millennials can access the same artful user experience state which defines a present world of mobile. With the use of Lightning Platform, these people are having the option of interaction, anytime, anywhere with their team of financial advisors on any device type.

5. Extended Data Model

The importance of the model of Salesforce Data is expanded to present the image of business entities like Household, Individual, Financial Holdings, Financial Goals, Financial Accounts, Assets & Liabilities, and Securities.

Having this platform and data model of Salesforce, the significant capabilities of Lookup and Master-Detail relationship, advisors are in the condition to easily witness the summarized information for individual goals, financial accounts, liabilities, and assets on the level of the household.

This model of data is easy for integration which accompanies external providers of data, and the third-party applications. This model of data is contrasting from the pre-existing Salesforce model of Person Account

or the party model of the industry.

6. A Look at Data Model

We’ve spent enough time talking about the data model. How about we look at a real live data model in the Schema Builder?

Have you seen an absolute data model live in Schema Builder? If not, then Schema Builder shows the below:

1. Fields including Account Number, Account Name, and Account Owner

2. Objects including Contact and Account

3. The relationship which includes Contact and Account relation.

You first have to log in the trail org of Financial Services Cloud of yours and go through home page navigation:

1. Click and choose the Setup.

2. When finding the box of Quick Find, get in the Schema Builder.

3. Click on the Schema Builder.

Turn a little bit around. Drag down to view other data model parts and in what manner they are in connection. Once you have a complete outlook, choose the objects present in list on the left side for displaying particular objects and to select their relationships.

7. Innovating At Speed

In the Salesforce Development, today the enterprises are in search of delivering innovation and creation in the segment of client experience to make innovative speed, the topmost priority.

The Salesforce service cloud including Financial and Banking Services Institute is in the limelight of accepting the digital transformation world as they are in search of winning the trust of more clients, serve better clients, and have the maintenance of more clients like never before. It’s vital to offer a more personalized and illustrated experience that fascinates both offline and online customers.

Do you know in what manner opportunities and leads are modeled?

Details of objects record that is standard in nature regarding customer leads which are new and the opportunities to offer clients with new and multiple products.

1. Agile and Efficient Operations

Manually managing your finances while searching for fresh business opportunities can be a bit problematic. It includes data input which is time-consuming which is likely to suffer from duplications and errors.

These will help you cut down on cumbersome tasks and focus more on attention-demanding responsibilities.

Making you help in the wealth management of yours faster and much more efficient, Salesforce Financial Services Cloud involves an in-built Lightning capability. In addition, it can easily boost customer productivity by using several tools like client dashboards and proactive and enterprising engagement cards.

These tools will let you help in cutting down the bulky and clumsy tasks and focus relatively additionally on responsibilities.

2. Integrate Everything

Ultimate for all sizes of businesses, this platform acknowledges you to delve into different ways through which you can guide your customers on their journey related to sales. You can also connect multiple business groups and household trusts. So, you can figure out in which way you can interact the best with each customer of yours.

To strengthen this, the platform contains integrated dashboard plus AI capabilities that give you actionable insights (the term used in analytics and information on big data which gives you all the future information related to it) on the behavior of client along with their business systems.

3. Making Wealth Management More Simpler and Easier by Agile Working Methods

While mainly designed for financial affairs management, the Salesforce Service Cloud even uses conventional CRM functions to help the entrepreneurs in performing effective wealth management.

By using it, you can gain access to features that allows the contacts to be connected to particular accounts along with giving you the ability to choose how to build up or accumulate the financial holdings at different levels. To provide a much “personalized user experience”, the platform is even armed with specific industrial features.

4. Better Team Collaboration

While relying on effective buy-side businesses and investment banks, Salesforce Service Cloud can offer you the tools you require to securely collaborate while engagement of streamlining client.

In collaboration, it allows connecting with client associates, insurance agents, and many more finance experts. Further, it is featured with Salesforce Inbox which helps you and your members of the team the access of CRM data, so you can have all the information regarding customer which you require for closing the deal quickly!

5. Secured Company Data

Your financial data is likely to be the most sensitive information that would be held by your company. It is, therefore, necessary to keep it secure in all conditions. With multiple security layers, Salesforce financial services cloud helps in monitoring the access and usage of these details. From field audit trail to event monitoring and platform encryption, this platform ensures the security of client information and other data that needs to be kept confidential.

This way, salesforce is probably going to serve you well enough.

+1 561 220 0044

+1 561 220 0044 +61 255 646464

+61 255 646464 +91 909 080

3080

+91 909 080

3080