Services

Merchant Cash Advance Software

The Merchant cash advance software works on the principle of managing loans with the help of digital technology such as cloud-based solutions. There is an ever-increasing of possible ways for implementing cash services for employees in various organizations. The MCA software has started resolving the issues in association with conducting all the processes online for E-Commerce businesses.

Merchant cash advance software is associated with many advantages for enabling the employees to choose the best possible ways of Editing the documents related to the business processes even when they are moving or commuting. The MCA servicing is

benefiting the people virtually for booking the movie tickets for Airlines. The MCA servicing can also be utilized for buying any type of product may it by the birthday present or sharing the query online which is troubling you for the past few days. The applicability of the MCA software lies in the fact that it can deliver any type of advantages associated with entertainment or delivering speedy solutions for dealing with the challenges from the online platform.

The cash advance software has diversity since they are responsible for supporting the people when they are expecting the solutions instantly and also help them in performing various activities irrespective of the location and platform. The cash advance software delivers flexible solutions for maintaining transparency across the business activities and also, ensure viable outcomes. The world is seeking advisers from experts to deliver solutions on time concerning the loans and other activities inside the banking sector especially. There is an urgent need of delivering the loan statement electronically which is sustained by the cash advance software. Every business process is trying to adopt those solutions that he can help and providing the fast solutions for executing the financial task in a short time.

GET IN TOUCH

Request A Free Consultation / Need Any Help For Business & Consulting

Advantages

Advantages of the cash advance software

The competitive world is showcasing its talent for improving every type of Business and monetary gains and they are adopting simplified solutions for managing the process effectively and intensely. Nowadays it has become impossible to avoid the competition faced by the different companies and the single step is to find an intelligent solution for dealing with the challenges and implementing the new technologies for fulfilling the ever-increasing demand of the employees as well as customers.

The banking sector especially is taking advantage of the automated solutions on behalf of the Salesforce development for improving their offering and simplifying every type of process so that they can easily execute the lending solutions for the general loans.

What is the reason behind the management of loans on behalf of the lenders?

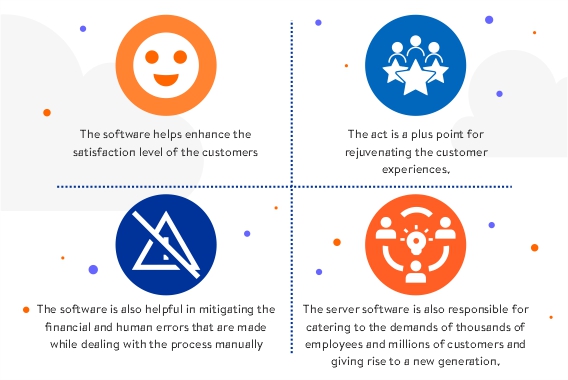

Apart from providing the benefits such as the provision of quick delivery of accessible services for obtaining loans and management software that deals with the lending solutions effectively, there is an additional requirement of arranging the loan servicing software because .

- The software helps enhance the satisfaction level of the customers

- The act is a plus point for rejuvenating the customer experiences.

- The software is also helpful in mitigating the financial and human errors that are made while dealing with the process manually

- The server software is also responsible for catering to the demands of thousands of employees and millions of customers and giving rise to a new generation.

GET IN TOUCH

Request A Free Consultation / Need Any Help For Business & Consulting

loan software

Learning the potential reasons for opting the loan software while decision makings

For making electronic payments

- The platform of the customer relationship management system on behalf of the salesforce across all the organizations. The customer relationship management-based platforms help edit the information which is saved inside the semantics of the Salesforce platform.

- This software allows the elimination of the manual calculation of reading of the information associated with the customers rather than provide a Legacy system for managing the data online with confidentiality.

- Today the cloud-based technology and cash advance software are helping in enriching the data saved inside the Salesforce platform so that we can easily maintain them across Systems by customizing the fields.

- The process of automating the origination and dealing with the processes of underwriting. The Salesforce development has started supporting the organizations concerning leveraging every type of technology that helps in making rigid decisions and they also support us and the integration of the internal data sources including the external ones. The smart solutions are capable of handling the bureaus and other organizations since they have the capability of maintaining real-time based data. These real-time solutions rising there are management models since they can automate the rich processes inside the banking sector that ranges from lending loans and mortgaging.

- Creation of transparent solutions for providing the unified view also called 360-degree view. The Salesforce development solutions are immensely supportive in relationship with the customers and employees since they give the overview of how they are going about the process such as landing the loans and managing the cash advance software on a single platform. All types of stakeholders are sharing the transfer interview and the stakeholders are underwriters and brokers who are directly or indirectly involved in the loan lending process.

- Providing the best benefit surcharge reporting on time and maintain the compliance results. The salesforce development also works in relationship to the management of the aggregated data to and from the external and internal systems for enhancing the interface of the salesforce platform.

These capable solutions have started to benefit the organization since they help set up the business rules for ensuring the right information is being shared across the two networks or systems and ensure the simplification of the compliance from one end to another. - Manipulating the products provided to the potential customers. It is another advantage of the Salesforce platform and cash advance software that helps in managing the company and the associated departments since they have the capability of combining the customer relationship management software and maintaining the credit decision system with full confidentiality and flexibility. The majority of the companies have started aggregating the information received from all the business processes file decision making and hence they can connect the two systems according to the consumeristic approach and not by the product approach.

- The setting of the incentives and offers for the potential customers which are already existing inside the organization. It is one of the potential ways of attracting the customers and fulfilling the demands by offering them pre-approved incentives.

There are many business Enterprises predominantly finalizing the loan for an individual after legalizing all the documentation process that allows a business company to specify some offers after validating the Identity of the person. - Describing the life events best practices and the specific behaviors for targeting the potential customers. These are some of the successful strategies the tell based on the Data Analytics system and helping out the typical Enterprises for predicting the requirements on behalf of the financial services. These specific demands are directly based on the behavior triggers such as the habit of saving money for marriages and education.

The integrated solutions of Salesforce have the capability of analyzing the decisions in a short time special for the big forms that deals with the loan processes every day and have a production of the services for the potential customers will come easy with the help of financial triggers and description of the life events.

Benefits

Benefits of the Salesforce integrated solutions and cash advance software

For making electronic payments

- The software works according to the robust decision framework and servicing processes. The main aim is to reduce the number of errors which are committed by humans due to their hectic burden of projects and plans to get executed. After prioritizing the plans and strategies for eliminating the errors there is a lesser chance that the customer what become dissatisfied and hence the payment process becomes easier which is one of the key determiners of the success of the business.

This software allows the elimination of the manual calculation of reading of the information associated with the customers rather than provide a Legacy system for managing the data online with confidentiality.

- The new generation is seeking intelligent solutions that can prepare themselves according to the competitive world within no time. The laws of using the software are also supportive in the simplest manner since they have the capability of understanding the requirements according to diversity and demography.

- Maintaining the accuracy level for collecting the right information of the potential candidates is another advantage of the Salesforce development that targets the successful approach together with the huge amount of traffic in terms of customer feedback and purchasing capacity.

- Completion of the customer view is another motive of any typical enterprise and for that, we need to collect thematic information for every customer so that the organization should be unified and unbiased. Salesforce integrated solutions and the software known as merchant cash software manager every type of detail while lending solutions to the customers and provide the broad base for picturizing the overall view causing concern on some of the specifications.

Takeaways

We hope that you have got sufficient data from the digital piece concerning the working of cash advance software. If you have any concerning questions, you can visit our website for further clarification.

OUR PROCESS

We Provide Most Exclusive

Process For Business

Listen

We connect you with our experts who try to understand your business requirements and challenges that you are facing with your current implementation by asking relevant questions

Suggest

We provide the best solution to your complex business challenges by considering what is right for the business and its customers instead of what we think is right. This is a real definition of digital transformation for us.

Implement

We believe in working together rather than for anyone because we all know together we always achieve more. Hence we act as your partners who are responsible for making you and your business successful with the implementation.

Iterate

We strive for continuous improvement instead of perfection. Hence we listen to your feedback and according to that, we focus on making improvements continuously within each milestone, sprint, and release.

+1 561 220 0044

+1 561 220 0044 +61 255 646464

+61 255 646464 +91 909 080

3080

+91 909 080

3080